Opportunities are present whether the stock market is bullish or bearish, but how to strategize to accumulate the best return on investments requires some expert advice.

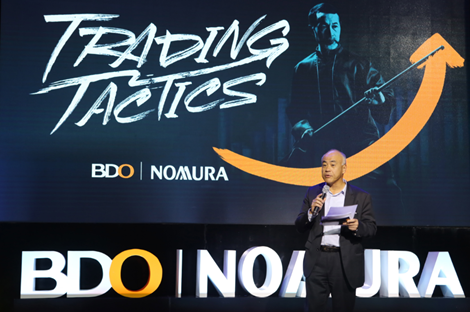

This is what online trading platform BDO Nomura Securities, the joint venture company between BDO Unibank and Nomura Holdings of Japan, recently did via the launch of “Trading Tactics,” a session featuring market intel straight from industry movers. Said event was shown live on Facebook as well.

“While stocks are perceived by many as risky investments, they are still considered as a better performer vis-à-vis any other type of security over time. With Trading Tactics, we will be able to create options for our clients to position their portfolio of investments,” said Koichi Katakawa, president of BDO Nomura.

The first Trading Tactics featured the SM Group, one of the country’s diversified conglomerates.

SM Investments Corp. (SMIC) head of investor relations Timothy Daniels said growth prospects are still abundant for the group, whose core businesses are retail, integrated property development and banking.

For first-timers or investors looking for stocks to put in their investment basket, he said the following attributes of the SM group can serve as a guidance:

· It is a leading proxy for the Philippine growth story;

· SM is among the best regarded companies in the world;

· It looks after its stakeholders—as an incubator of business, catalyst for developing communities and an enabler for vendors, tenants, and other MSMEs;

· It is a top employer with international recognition; and

· It is recognized as being responsible and sustainable, as measured against global standards.

“Despite having achieved the scale we have today, you might be surprised to hear that we think we are still quite small. Because in all of our business, in each of the sectors we participate in, the potential for growth is still huge,” said Daniels.

In retail for instance, less than a third of food today is sold in a modern format. In the property sector, on the other hand, the country still needs over 5 million new homes and even more in the future. Meanwhile in banking, only about five percent of Filipinos have a mortgage or a credit card today, and about 60% of Filipino adults don’t even have bank accounts.

“The biggest opportunities are in the many provinces where incomes are rising fastest and the growing population is not yet served very well—especially in Visayas and Mindanao and also in Northern Luzon,” noted Daniels.

Called by market experts as a growth stock, the SM Group has rewarded investors over the last 10 years with an average share price increase of 25% a year.

“Though we can never guarantee to always deliver that kind of financial return, especially as we grow larger over time, we do guarantee to keep growing responsibly and sustainably; to stay close to our customers and doing what we do well; and to bring our stakeholders, including our investors, with us on that journey,” Daniels promised.

Apart from Daniels, other speakers include John Nai Peng Ong, chief finance officer of SM Prime Holdings; Richard Tan, first vice president of investor relations and corporate planning of BDO; Alexander Escucha, senior vice president and head of investor and corporate relations group of Chinabank; and, Bernhard Tsai, chief operating officer of BDO Securities.

Trading Tactics. Koichi Katakawa, president of BDO Nomura, opens the first session of “Trading Tactics,” which features the SM Group, one of the country’s diversified conglomerates. Shown live on BDO Unibank’s Facebook page, the video has been played nearly 300,000 times since its October 19 airing.